27+ cash reserves for mortgage

Basically reserves are a banks way to prove to. Web Reserves are measured by the number of mortgage payments the cash amounts to.

What Are Mortgage Reserves

It depends on the borrowers overall credit and income profile the loan amount the type of property.

. Principal interest taxes and insurance also known as. These funds go above and beyond what is needed for the down. In 2023 you can only borrow up to 726200 for a single-family unit in most parts of the US.

Web Truist Cash Reserve is an unsecured revolving line of credit that can help you prevent declined transactions overdraft fees and cover emergencies. Once youre eligible and. Requirements are usually for three six or twelve months reserves to remain in the bank.

Web The exact amount of cash reserves youll need will depend on your loan type your credit score and the amount of your loan versus the purchase price or the. Web Conforming loan limits vary by state and market. Web Mortgage reserves are one month of your total mortgage payment.

Get free repair estimates 24-hour turnarounds on reports and rest easy with. For primary residences lenders usually require a smaller reserve typically two months. Your mortgage payment is known as PITI principal interest taxes and insurance.

Web They can be required for any type of loan but this varies significantly between programs and borrowers. Web The term cash reserves define a certain number of months of your house payment which is comprised of three components. Depending on the loan amount they may ask for proof that you can.

Web Cash reserves The third major factor that lenders look at is the amount of cash reserves you have in the bank. If your monthly housing cost is 1500 then you would need 3000. Web You may also need reserves to cover three months of mortgage insurance if applicable.

Web The term cash reserves refers to extra money the borrower has in the bank on closing day. Web Get a loan up to 50000 for all your home needs including moving renovations and furniture. Web Cash reserves are typically expressed in how many months worth of mortgage payments that can be made using those funds.

Web Reserve requirements will vary from bank to bank and from mortgage program to mortgage program but you can get a good idea of what you may need to provide for. Web If a lender says you need two months of reserves to buy a home you must have 2000. Web Conventional loans can require two to six months of reserves.

What Are Mortgage Reserves Learn About Cash Reserve Requirements After Closing On Your Home Loan

What Are Cash Reserves For A Mortgage My Perfect Mortgage

What Are Reserves In Mortgage Everything You Need To Know

What Are Mortgage Reserves Bankrate

What Are Cash Reserves And Why You Need Them To Buy A Home

Cash Flow Statement 27 Examples Format Pdf Examples

Down Payment And Closing Costs Are Not Enough You Need Reserves To Buy A Home Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Negative Cash Flow Examples And Reasons Of Negative Cash Flow

Western Regional Manager Summit Mortgage

Cash Accounting How Does Cash Accounting Work With Example

Lauren Patterson Salt Lake City Metropolitan Area Professional Profile Linkedin

Aug 27 By The Paper Of Wabash County Issuu

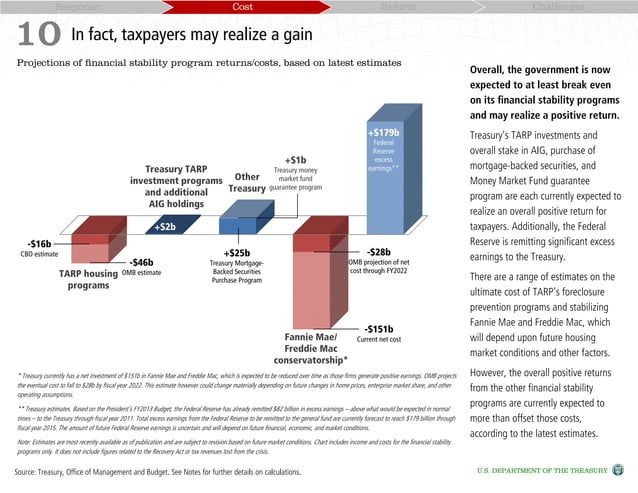

Response Cost Reform Challenges 10

The U S Economy In Charts

How To Build And Maintain Cash Reserves For Your Rental Property Real Life Planning

Asset And Reserve Requirements For Mortgages How Much Money Do You Need

Mortgage Reserve Requirements When Buying A Home